This solution was developed to allow setting up fiscal year budgets for all anticipated labor and taxes and insurance using Job Labor Budgets for financial budgets.

If you want the Budget Report, Budget Income Statement, Budget Income Statement: Current vs Prior, and Comparative Income Statement to use the Job's Daily Labor budgets, system calculated tax and insurance budgets, and Work Scheduling budgets, you will need to add this Custom Setting.

| Section | Item | Value |

|---|---|---|

| GLReport | UseDailyBudgets | Yes |

Once this Custom Setting is in place, a "Use Daily Labor Budgets" check box displays on the Budget Report, Budget Income Statement, and Budget Income Statement: Current vs Prior, and Comparative Income Statement report option screens. The check box is selected by default.

If this check box is selected and there is activity in the daily labor budgets for a GL number that is already being budgeted for in the financial budgets area, the Daily budgets will override and replace the financial budget. We suggest that you do not budget for labor and tax and insurance in the GL Budget area, instead let the Daily Budgets rule. The only exception to this would be for a Job where there are no labor budgets set up in the Job Master File.

In addition, if this Custom Setting is in place, an additional check box displays that allows you to include Work Scheduling Hours in Labor Budgets. This check box is selected by default.

Note: Note that TEAM recommends an approach which: 1) Uses Job Cost Reports to manage working budgets (micro budgets); 2) Sets up financial budgets according to your anticipated growth and plan for the fiscal year, and make no changes to the budgets (macro budgets)

Criteria for including Work Scheduling Budgets

- Status cannot be "Skipped".

- Update to Job Budgets on the WS Schedules (Who tab) must be selected.

- Schedule Date must be within the time period of the financial.

- The GL number associated with the Hours Type needs to be in the Financial Statement format.

Formatting Financial Statements

The Labor Accounts are still in your financial format, as they should be in order for them to display on your financial report.

In order for the system to know where to print the Budgeted Tax and Insurance dollars from the Daily Budgets, you will need to set up a special financial format. The special format needs to include Property 9 - Tax and Insurance Total.

When the system finds a Property 9 in your financial, it will total and print the budgeted tax and insurance dollars that go with the Labor lines above it.

It is okay to have Property 10 (contra line) in your format because you may want to bring through some system calculated Tax & Insurance actuals. The contra line (Property 10) will zero out the system calculated Tax & Insurance actual amounts on the overall company report.

If you are using the Tax Allocation by Job feature (Payroll Defaults (Misc tab)), you enter a Cut-Off date to indicate the last date you want the system to pick up System Calculated Actual Taxes and Insurance amounts. If you do not enter a date, the system will not pick up any system calculated Actual Tax and Insurance dollars.

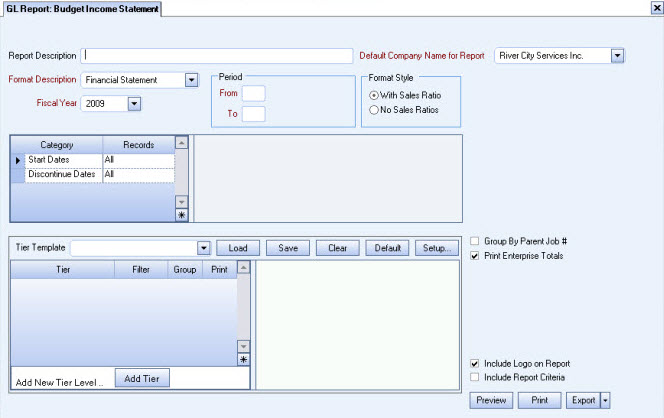

Budget Income Statement

Note: When a Job is set up to use both GL Budgets and Daily Budgets (Custom Setting required for Daily Budgets), the report will use the daily budget amount.

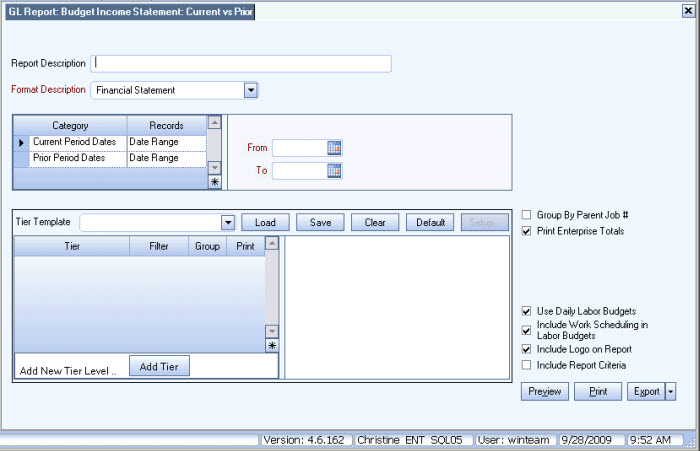

Budget Income Statement: Current vs Prior

Provided the Use Daily Labor Budgets check box is selected, the report will gather all Daily Budget details and total each by General Ledger number.

The amount from the General Ledger Number(s) of the Daily Budget details will replace the GL Budget (if one exists for the General Ledger Number(s)).

Note: When a Job is set up to use both GL Budgets and Daily Budgets (Custom Setting required for Daily Budgets), the report will use the daily budget amount.

The Tax and Insurance budgets will total and print for any line in the format that is using Property 9 (Tax and Insurance Total). The system will use the budgeted Tax and Insurance amounts that are attached to the Daily Labor budget records.

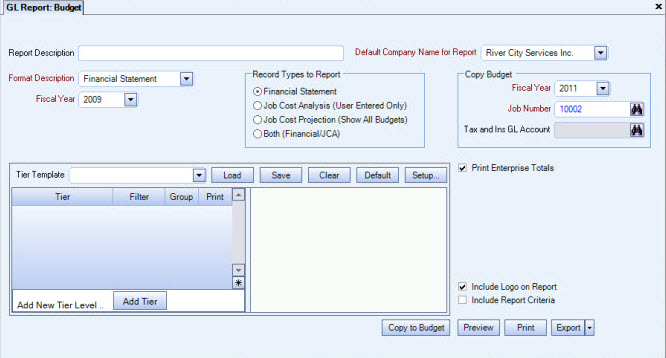

Budget Report (Financial Statement only)

This applies ONLY to the Financial Statement Record Types to Report.

Along with Labor Budgets, the system will also pick up and print the System Calculated Tax and Insurance budgets.

The Job Cost Analysis and Job Cost Projection will always look at the Daily Labor Budgets and Taxes and Insurance. Make sure that you do not have any labor budgeted in the Financial Budgets area for any Job that you have Daily Budgets set up for, if you are using this new feature.