In order to include the system calculated Payroll Taxes and Insurance into your financial statements, the formatting needs to include some special lines. One reason you would want to include this calculation into financial statements is so that manual journal entries do not need to be made to each management level for financial reporting. By doing some special formatting, the system will pull the appropriate Tax and Insurance entries that it has stored with the Actual Labor being printed on each management report.

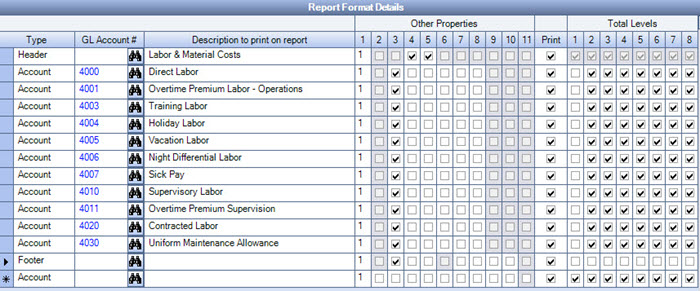

The format for the Financial Statement needs to include a special footer after each list of labor accounts. Since most companies split their labor up on their financials showing direct and supervision together, and possibly as a separate section their Sales and then Admin labor, you would have three special footers listed in your format. The footer will have a Description similar to Payroll Tax and Insurance Calculated. The Other Properties numbers 3 and 9 need to be selected. Whenever the system runs across a line in the Financial Statement Format with check box 9 (Taxes and Insurance Total) selected in the Other Properties area, it will total any Payroll Taxes and Insurance dollars associated with the labor accounts preceding (before) the footer. If the Print check box is selected the system then prints the dollar amount of Taxes and Insurance on the Financial Statement if asked to do so. When it runs across the next line with Box 9 (Taxes and Insurance Total) selected in the Other Properties area, it adds all Payroll Taxes and Insurance entries together, since the last line with a Box 9 selected and prints the total.

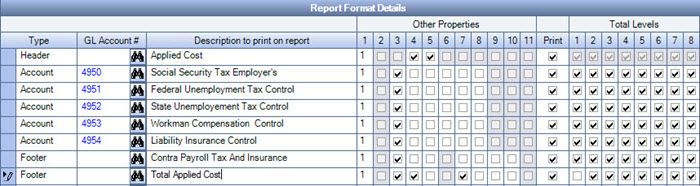

The other line item that should be added to the Format for the Financial Statement is the Contra Payroll Tax and Insurance Footer. This is the reversing entry of the Payroll Tax and Insurance printing with each labor grouping on the financial statement. Make sure this line item is placed in the format some place after the last Footer for the Tax and Insurance Total. This line prints only on the Total Company Level report. The Footer for the Contra line is normally placed in the format under a Header for Applied Payroll Cost. This section of the format would include the expense accounts used to post the actual cost incurred by the company for the payroll related cost.

By using the example below we will explain this feature in more detail.

Let us assume the General Ledger contains the following data for the month of September 2001.

| Date | G/L# | G/L Description | Job # | Labor $ | T&I $ |

|---|---|---|---|---|---|

| 09/15/01 | 4000 | Direct Labor | 1000 | 50.00 | 10.00 |

| 09/15/01 | 4000 | Direct Labor | 1001 | 100.00 | 20.00 |

| 09/15/01 | 4010 | Supervisory Labor | 1900 | 30.00 | 6.00 |

| 09/15/01 | 4500 | Sales Salaries | 150 | 40.00 | 4.00 |

| 09/15/01 | 5000 | Admin Salaries | 940 | 60.00 | 5.00 |

| 09/15/01 | 2010 | Officer Salaries | 950 | 60.00 | 5.00 |

Now let us assume the format for the Financial Statement groups the accounts in the following manner:

| G/L # | Type | Description | Amount |

|---|---|---|---|

| Header | Direct Cost | ||

| 4000 | Account | Direct Labor | 150.00 |

| 4010 | Account | Supervisory Labor | 30.00 |

| Footer | Taxes and Insurance Calculated | 36.00 | |

| Footer | Total Direct Labor Cost | 216.00 | |

| Header | Sales Cost | ||

| 4500 | Account | Sales Salaries | 40.00 |

| Footer | Taxes and Insurance Calculated | 4.00 | |

| Footer | Total Sales Labor Cost | 44.00 | |

| Header | Administration Cost | ||

| 5000 | Account | Admin Salaries | 60.00 |

| 5010 | Account | Officer Salaries | 60.00 |

| Footer | Taxes and Insurance Calculated | 10.00 | |

| Footer | Total Admin Labor Cost | 130.00 | |

| Header | Applied Payroll Cost | ||

| 7000 | Account | FICA/Medicare Tax Control | 25.00 |

| 7001 | Account | UC Tax Control | 5.00 |

| 7002 | Account | Insurance Cost | 15.00 |

| Footer | Contra Tax and Insurance | -50.00 | |

| Footer | Total Applied Payroll Cost | -5.00 | |

| Total All Labor Cost | 385.00 |

The G/L Account #'s 7000 through 7002 are General Ledger account numbers where the actual company cost was posted. Note: Currently the system can automatically post the FICA, Medicare, and Unemployment Employer’s expense if the Tax Tables are set up to do so, but for the other expenses such as Liability and other Workers Comp Costs, this would have to be done via an Adjusting Journal Entry.

Notice the calculated Taxes and Insurance entries total $50.00 in the financial statement, which agrees with the memo entries in the first table. Also, note that the Footer for the Contra Tax and Insurance is -$50.00. The net effect of the system calculated entries is zero. The total of all labor costs represents the labor (via payroll) and the Tax and Insurance costs (via Adjusting Journal Entries and payroll).

All things being equal the Total Tax and Insurance cost (-$5 as above) can very easily be a net credit because Unemployment Compensation taxes will run under the Tax and Insurance percentage entered in the Tax and Insurance screen in the Job Master File.

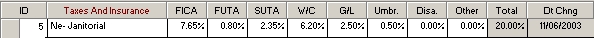

Suppose the Tax and Insurance total percentage for Janitorial – Nebraska is 20.00% computed as follows:

For State Unemployment, the taxable wage is actually less because of the people that exceed the taxable wage base. The factor used by the computer is a constant 20.00% and does not reduce itself for people exceeding the wage base. Other elements can alter the Total Tax and Insurance cost such as:

- Estimated Labor on the Insurance Policy varies with the actual wages

- Insurance amortized 1/12 equally whereas actual labor varies from month to month

- Self Insured Plans are based on losses and loss trend rather than fixed premiums

- Some highly compensated employees will exceed the FICA limit

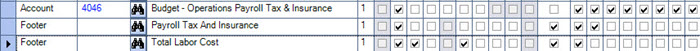

If you print one of the Budget Financial Statements, the format should include a line for Budgeted Payroll Tax and Insurance. This is the line you will enter your Budgets for Tax and Insurance. The example below shows how the format should be set up in order for the Calculated Tax and Insurance and the Budget Tax and Insurance to print on one line.

The format contains three lines of information regarding Taxes and Insurance. Two of the lines are not selected to Print.

The first line is a Footer with a Description of Payroll Tax and Insurance Calculated and has Box 9 selected for Tax and Insurance Total. This is the line for the system-calculated amount that was posted with each labor entry during payroll processing.

The next line is for the General Ledger account number used to set up the budget. The budget amount needs entered into the Budgets area of the General Ledger.

The third line is a Footer with a Description of Payroll Tax and Insurance. This line is selected to Print. This Footer causes the Tax and Insurance Calculated and the Budget for tax and insurance to print together on one line when a Budget Financial statement is printed.

The three lines need placed in the Format of the Financial Statement after each labor grouping (i.e. Direct Labor, Sales Labor, and Administration Labor). This allows for the calculated and budget amounts to print on the report with the appropriate labor grouping.