Writing Off a Bad Debt

If an amount (or part of an amount) becomes uncollectable, you will need to write it off as a bad debt. Use this procedure to write off the entire invoice or a portion of an invoice.

Preparation

You will need the following information to post each entry:

- Company #

- GL Cash Account

- Deposit Date (write off date)

- Customer Number

- Check Number

- Payment Type

- Payment Amount

- Adjustment (write off) amount

To write off a portion of an invoice

- Click Accounts Receivable, and then click Payments.

- Enter the Customer Number, or use the Quick Lookup feature to locate the Customer Number.

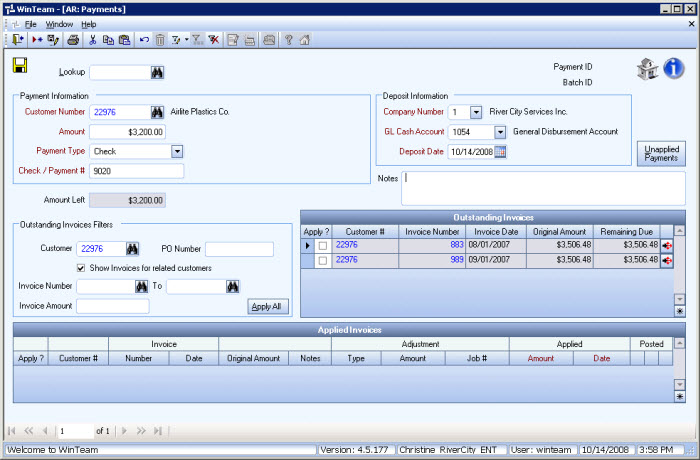

- In the Payment Amount field, type the amount of the payment received.

In our example, we will use $3200.00 as the payment amount and we have agreed to write off $306.48 from Invoice # 883.

We will enter $3200.00 in the Payment Amount field.

- In the Payment Type field, type or select Check.

- Enter the Check Number of the partial payment.

- Select the Company Number that the invoice belongs to.

- On the GL Cash Account field, type or select the account where the you will post the payment. For more information on GL Cash Accounts, see Learning about Default Cash Accounts.

- In the Deposit Date field, type the date when the decision was made to write off the debt.

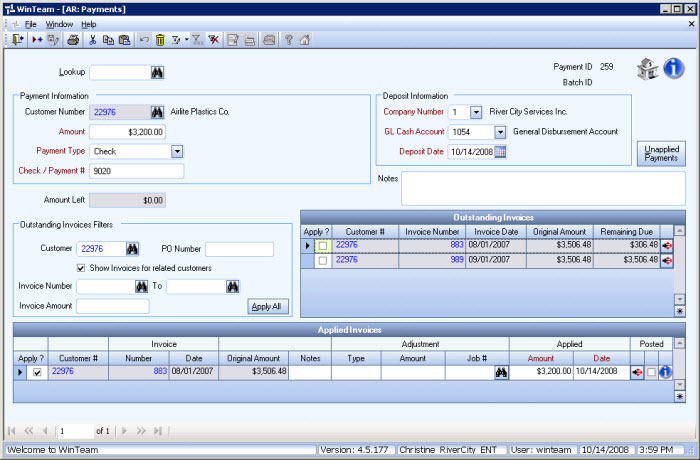

- Select the Apply? check box next to the invoice where you want to apply the payment.

Once you click the Apply? check box, the payment moves from the Outstanding Invoices >grid to theApplied Invoices >grid.

- Notice that there is $306.48 for this invoice still outstanding.

- Click the Apply? check box for Invoice Number 883 in the Outstanding Invoices area.

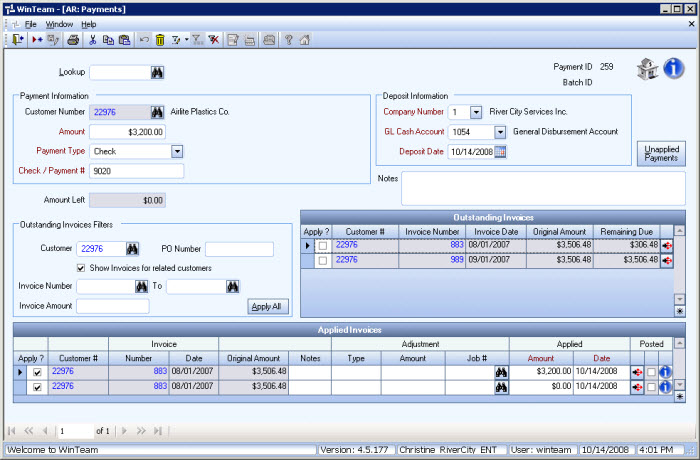

- Once you click the Apply ? check box, a message displays confirming the adjustment.

- Click Yes.

The remaining invoice moves from the Outstanding Invoices grid to the Applied Invoices grid.

Notice the Applied Amount displays $0.00.

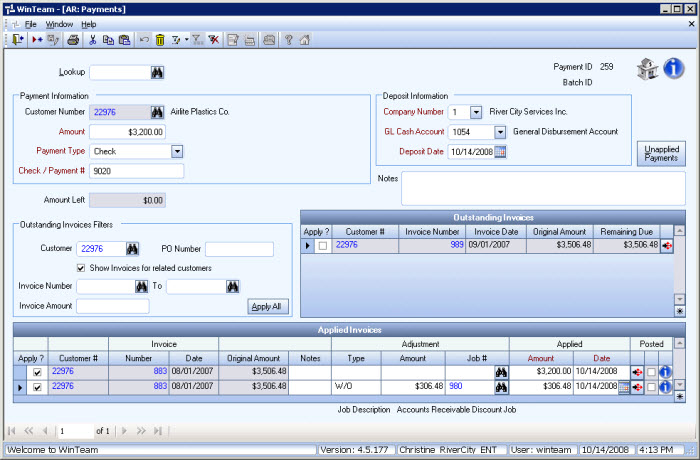

- In the Applied Invoices grid, select W/O in the Type field.

- Enter $306.48 in the Adjustment Amount Field.

- Enter the Job # to apply the write off to.

- You may require a password to proceed (if one was set up in AR: Defaults).

- Enter $306.48 in the Applied Amount field. Your invoice amount is now $0.00.